*This article was originally published on SmartFunding’s Medium.

Parallel to how early alt-rock underground movements revolutionised the rock genre before integrating themselves into the mainstream airwaves, what began as alternative platforms that aimed to provide non-traditional financing options are now collectively growing into a global, US$145 billion-dollar industry — and are making us reconsider how we think and do finance.

Labelling something as ‘alternative’ — whether it’s a fact, a practice, or a product — could potentially discourage public interest, plant seeds of doubt, or even result in a crisis of trust. But not everything that’s associated with the term has a heavy air of uncertainty hanging over them. An ‘alternative’ may be a non-traditional or unconventional entity that has the potential to challenge or disrupt social norms, shift paradigms of thought, and even transform a way of life.

For example, tracing back as far as the late 1970s, then avant-garde rock music — punk, grunge, and their many variations — kicked off as underground, resistance movements that aimed to promote self-expression and address social and political issues. Beginning with the Sex Pistols, punk rock quickly captured an entire generation of young artists and audiences; the new sound, shaped by their rejection of the commercialism of mainstream culture, gave rise to the term ‘alternative rock’. In the next decade, as more and more people embraced the sound and record labels signing bands one after another, alt-rock inescapably integrated into mainstream music and evolved into an umbrella of sub-genres, producing newer and more diverse sounds. Alt-rock reached its commercial peak in the early 1990s, primarily due to Nirvana’s phenomenal success and immense impact on the contemporary pop musical landscape.

That the alt-rock landscape was defined by a group (that rejected a then-mainstream rock and roll sound) and their fervent desire to challenge dominant, but old-fashioned institutional ideologies only proves that members of society have the capacity to create and effect social or institutional change. Today, we see similar movements gradually unfold in various industries: from radically changing the way we consume and produce entertainment (such as Spotify and Netflix); embracing the sharing economy (Uber and Airbnb); to breaking barriers and encouraging reforms within and outside institutional fortresses like banking and finance.

Alternative finance is revolutionising the way we think and do finance.

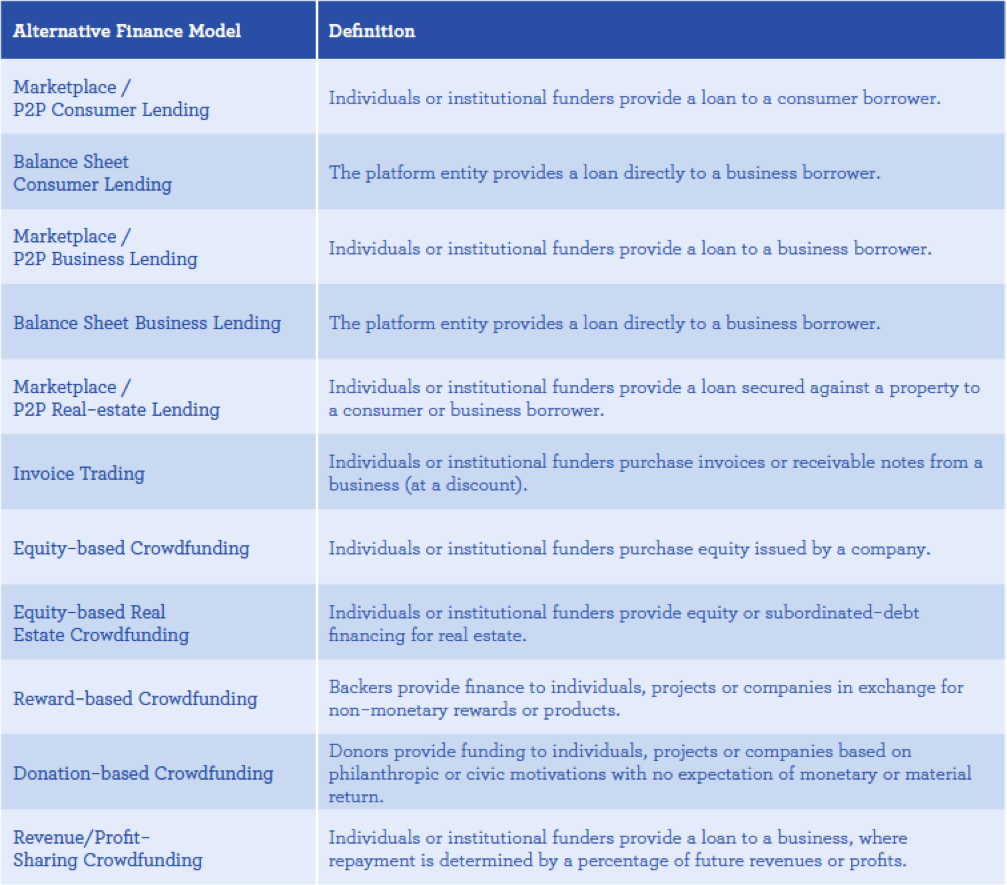

While banking institutions continue to provide one of the most reliable sources of business financing today, since the 2008 global financial crisis, an increasing number of borrowers, investors, and entrepreneurs have been on the lookout for financing solutions outside traditional offerings. People started feeling that they shouldn’t rely heavily on banks for financing solutions. And even banks themselves have become extra cautious about moneylending for various reasons (for example, higher capital requirements that disproportionately affect funding for small and medium businesses or SMEs). The result? There is a rise in the number of alternative financing platforms ranging from equity-, donation-, or rewards-based crowdfunders; invoice traders; to various types of marketplace and peer-to-peer (P2P) business lenders.

Most of these companies now employ fintech solutions, which they believe will revolutionise how we think about and do finance. They are constantly rethinking the nature of lending and payments processes, and reimagining how we collect, transfer, and save money.

So, in a somewhat comparable fashion, alternative lenders — armed with their passion for technology and innovation — have been attempting at something like what alt-rock musicians and audiences had done some decades ago: challenging establishments, disrupting social norms and shaking up the way we, as a society, think and do things.

Alternative finance is turning into a social revolution.

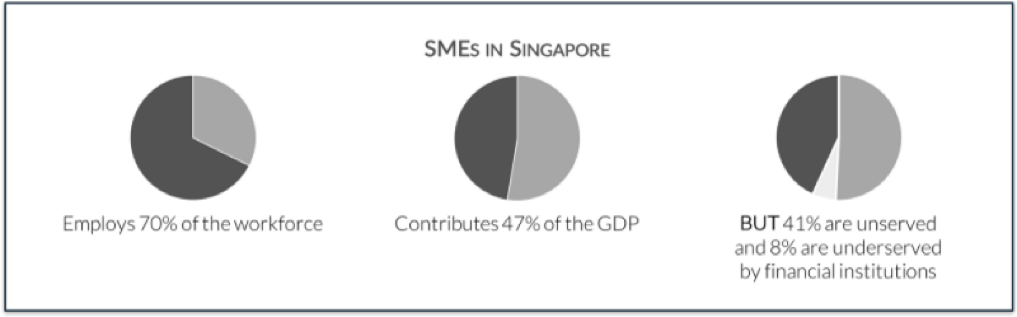

Because of the large institutional gap between banks and small businesses, the stringent and time-consuming financial application process, huge collateral requirements, and a tightening credit environment (along with many other factors), SMEs’ demands for financial access continue to be underserved by banks. Thus, in the post-global financial crisis era, the alternative financing sector has taken initial steps to help SMEs overcome cashflow problems, weather volatile markets, and survive underperforming economies.

In the process, alternative lenders have created themselves a worthy social cause, their current raison d’être: to champion SMEs and help them grow by providing tailored solutions and accessible models of business financing while also providing an attractive business proposition for their own investors.

Alternative finance, however, is also turning mainstream.

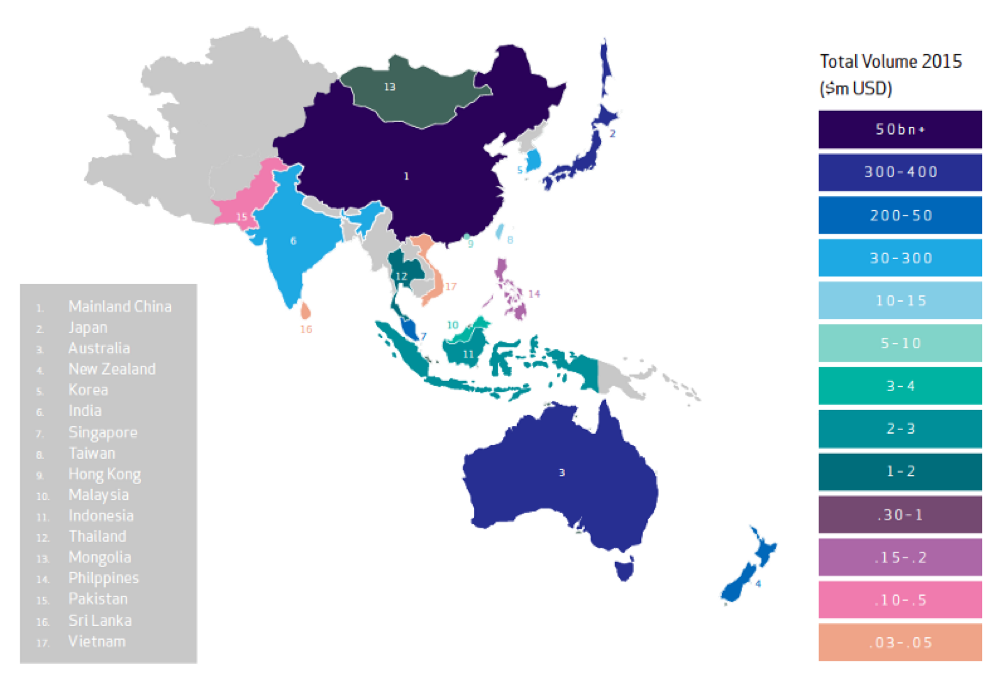

The transition from alternative to mainstream is inevitable. In 2015, alternative finance ballooned into a US $145 billion-dollar global industry, with China accounting for 70% of the global volume (KPMG, 2016). Closer to home, Singapore remains the market leader in Southeast Asia (although it is still at its infancy stage), generating $70.28m or approximately 84% of online alternative market volume in the region between 2013 and 2015 (Zhang et al., 2016).

Moreover, integrating fintech solutions into alternative finance platforms is bearing fruit in key markets around the world. In the UK, many alternative financing companies that offer online/digital solutions are now growing at a phenomenal rate, building sophisticated infrastructures that involve risk assessment, compliance, and legal teams. And in the US, alternative lenders are witnessing business growth gradually climbing back up to pre-2008 financial crisis levels.

Fintech startups in the Asia-Pacific (APAC) region are also taking the alternative finance market by storm. In China alone, visible online alternative finance transaction volume increased from $5.56bn to $24.3bn, translating to a 337% year-on-year growth. The APAC market is becoming much more diverse, now with 11 different alternative finance models for borrowers and lenders to choose from.

Will a ‘mainstream’ alternative financing solution ever replace bank financing?

Fintech developments in the alternative finance industry are becoming an increasing threat to traditional bank financing. But it is important to note that alternative financing platforms are not substitutes for traditional bank financing, which remains one of the most reliable and important financing options for individuals and businesses. Alternative finance providers view their platforms and financing models as part of a wider set of possible solutions that enable borrowers and investors to make decisions following their financial goals or business needs.

Sandra Ernst, who runs the fintech startup SmartFunding — a P2P invoice financing platform in Singapore — succinctly describes the ideal role of alternative finance/fintech solutions in the market:

“What we offer them is a financing solution that is flexible and accessible and will ideally be used in combination with other long-term and short-term financing solutions (if those are available to them) like government funding and grants, and bank loans.”

For Sandra, fintech companies will enhance the financing spectrum accessible to SMEs and particularly help businesses that don’t have or only have limited access to bank financing or require financing solutions that are more tailored to their needs.

The alternative finance market is still small compared to the total market size, so bankers don’t really have to worry about alternative providers eating their lunch just yet. However, investors — both institutional and retail — are expressing greater interest in this market, thanks to the SME sector’s increasing appetite for alternative forms of financing.

Ultimately, the goal of alternative finance/fintech companies and banks should be to work together and complement each other. Bank offerings might change, and fintech companies might eat some of the bankers’ lunches. However, market restructuring could occur due to bankers’ changes in taste or increasing preference for a different menu. Nonetheless, this would mean more financing options available to SMEs, more transparency, and quicker access to finance in the future.