SmartFunding Lets You Invest In Regional SMEs, First-Timers Can Begin With Just $100

Invest in Singapore SMEs & claim returns of up to 24%.

SmartFunding Is A FinTech Platform That Lets You Do Good While Investing In SMEs

Investing. A concept that’s almost as hard to crack as adulting. While some already believe these concepts go hand-in-hand on the daunting road to financial independence, others remain unconvinced that our savings will do fine by sitting prettily in our bank accounts.

These days, we’re also looking for a way to also do some social good—in light of living with a pandemic for close to 2 years.

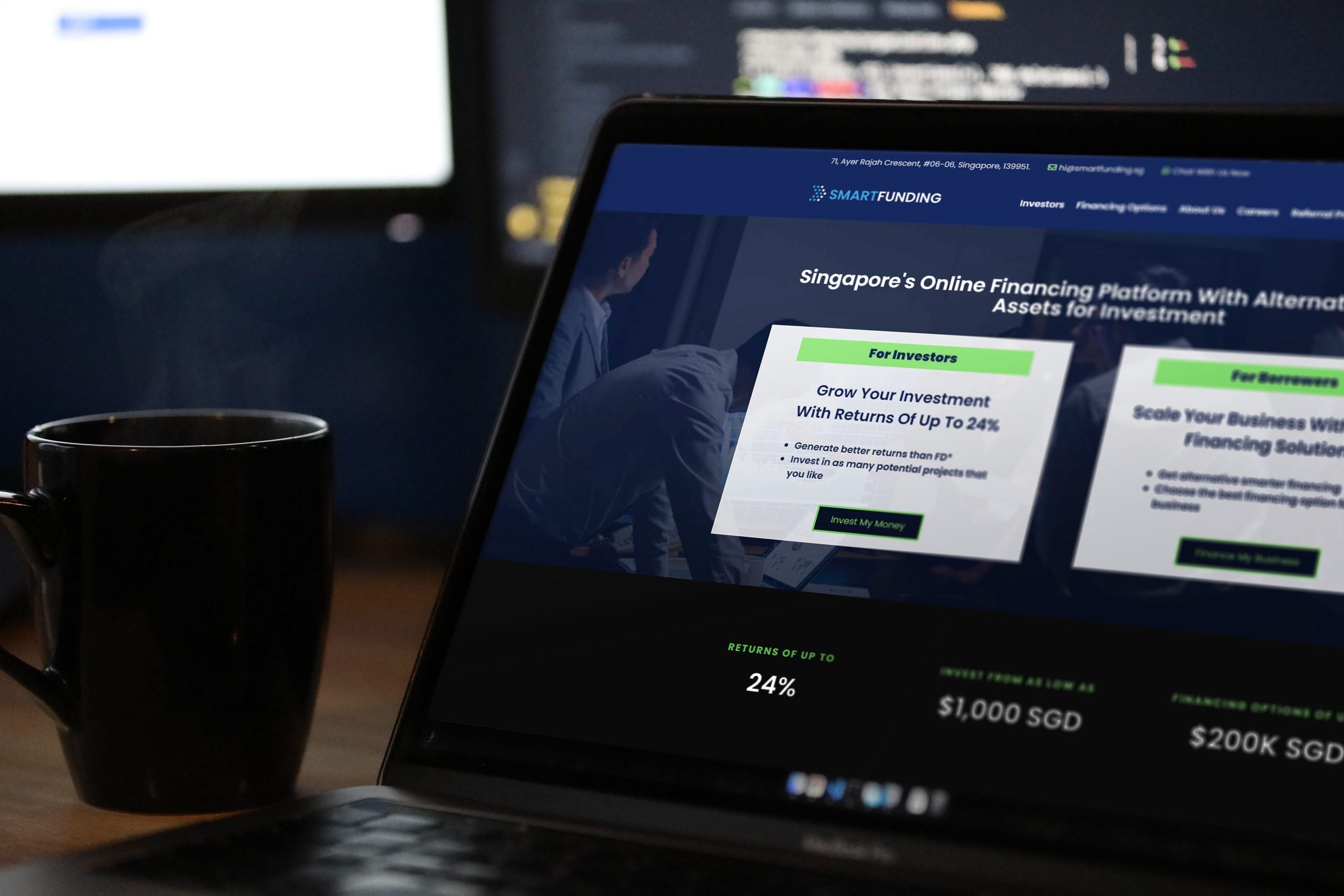

Enter SmartFunding, an online financing platform that lets you opt for not only Singaporean but also Malaysian MSMEs/SMEs to support and earn returns of up to 24% along the way.

Here’s the lowdown on how to get started if you’re a first-timer who wishes to dabble in your first foray into investments with just $100.

Invest automatically with SmartFunding

We’ve probably encountered financial advisors hovering around the MRT station’s exits who’ve uttered these phrases to us to convince us to start investing.

We must “combat inflation”, “make our savings work harder”, and above all else, think about our own “risk appetites”. Social anxiety aside, there’s a sliver of truth to their advice.

What’s rather confusing, however, is how to get started. That’s where SmartFunding – a fintech platform – comes in to simplify matters.

Just like the shopping apps you often use, SmartFunding simply requires you to sign up and log in to your investor dashboard, which usually takes less than 5 minutes.

Once there, you can pick whichever SME projects you’d like to invest in according to your personal risk appetite or interest. Everything is displayed clearly, including the returns, monthly repayments, and duration.

If you’d like to skip the manual steps, you can take advantage of their ‘Auto Invest’ feature which lets you invest within parameters that you define, such as minimum or maximum investment notes.

Think Tinder, but swiping through profiles of SMEs to invest in, rather than potential soulmates.

If there’s a match, you’ll get to add the businesses to your portfolio of investments. A portfolio that can be automatically diversified to divide our eggs into different baskets—a surefire way to mitigate risks.

Helping local SMEs stay afloat during the pandemic

Now that we’ve addressed the making money part of the platform, let’s proceed to discuss how SmartFunding aims to give users a chance to do good in the community.

Local brands and startups affected by the pandemic often require interim funds to tide over tough times. Needing a loan, however, doesn’t diminish how much potential these brands have to grow.

A great time to invest in these brands would actually be to support them now, rather than later, once they’ve taken off. If you think you’ve got the eye to spot potential rising stars in an array of industries, here are a few success stories to provide context.

Industry Case Study 1: Sports Goods & E-Commerce

A sports goods brand – specialising in basketball products – has established itself as a main distributor in South East Asia.

Though it used to deal in mainly B2B listings by supplying companies with equipment, it made the switch to e-commerce – working with Shopee, Lazada and Zalora to reach customers directly.

Within 1 year, the brand saw revenue soaring up to 167.09%, up from $300,686 on 30 Jun 2020 to $803,113 by 30 Jun 2021. A rousing finish to a financial year indeed, and an opportunity to share a slice of this investment pie if you so desire.

Industry Case Study 2: Construction & Hardware

Incorporated on 13 Jun 2011, this other brand’s main business is in supplying hardware and building materials, including steel bars, cement and timber.

For over 10 years, operations have expanded regionally, dealing with construction projects based in Malaysia. SmartFunding claims to have verified purchase orders totalling around RM700k for Aug & Sep 2021.

The director also shared with them that they estimate up to RM5 million worth of orders to be secured by end-2021.

We’re glad things are looking up for them, but it’s also a good chance to hedge your bets if you’re intending to support the construction industry via investing in similar companies.

As a beginner investor, or perhaps someone who’s just looking to build a portfolio closer to home to support local businesses, rest assured that there are a myriad of options similar to these case studies to choose from.

Every SME listed on SmartFunding’s platform has also been vetted to ensure your investments are pre-filtered to mitigate risks.

Do note that it’s still wise to do some research of your own, prior to confirming your deals, just to have the full context.

Secure logins via Singpass

As for how much is required to start investing, starting from as low as $100 is possible as well if one’s risk appetite tends towards conservative.

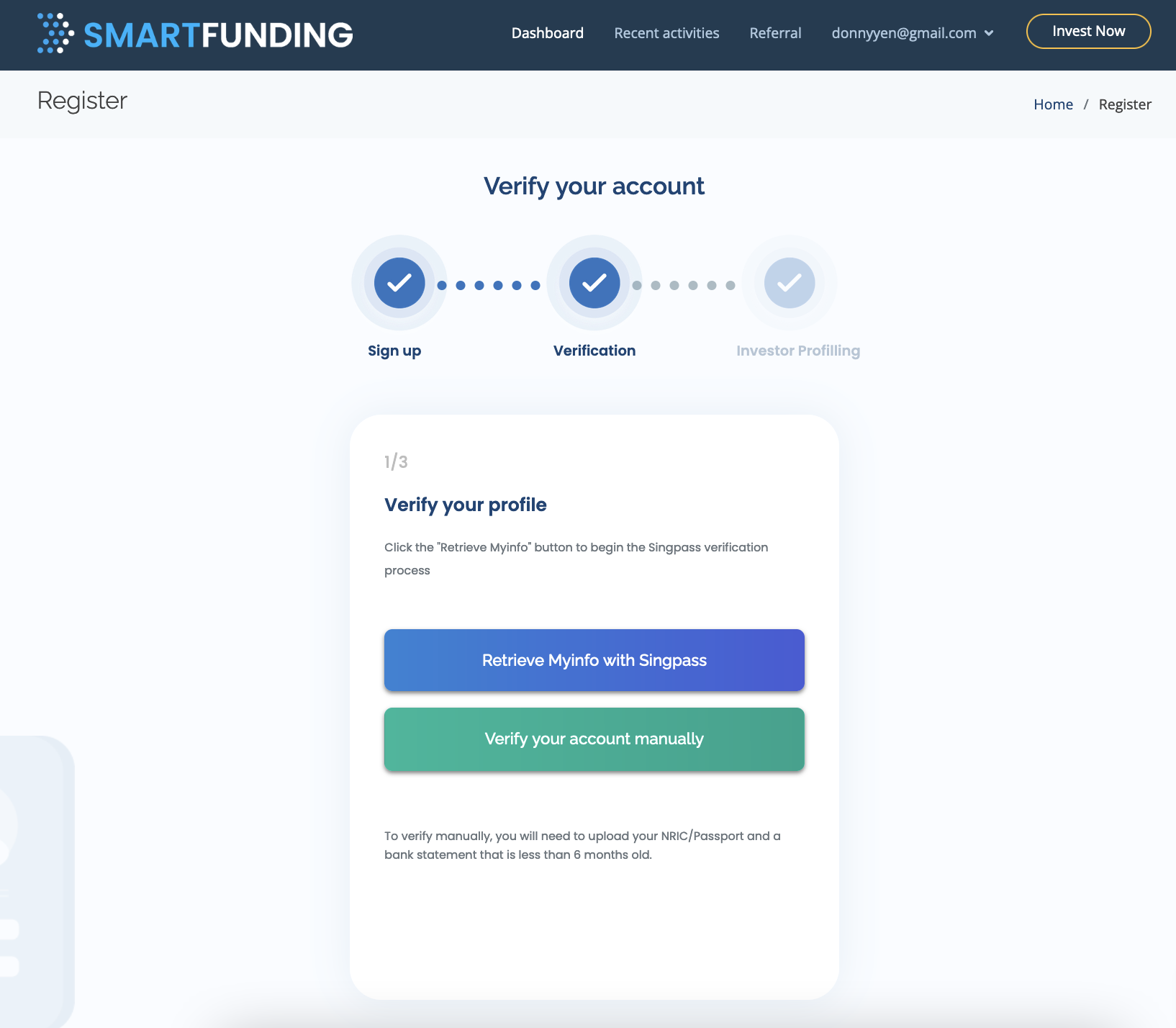

To assure users that the platform is legitimate though, SmartFunding is open about being regulated by the Monetary Authority of Singapore (MAS). Retrieving info via Singpass is also possible as part of the platform’s verification process.

To do this, you’ll just need to take the necessary steps below:

- Click on ‘Verify Now’ once you’ve signed up as an investor

- Select “Retrieve Myinfo with Singpass”

- Scan the Qr Code with your Singpass app to log in

- Begin browsing SME projects to invest in on SmartFunding

Image courtesy of SmartFunding

Image courtesy of SmartFunding

We’ve also completed a guide on how to navigate the website and join as an investor here.

But don’t just take our word for it, head over to SmartFunding’s official website here to try it out yourself.

If you’re afraid of feeling FOMO, be sure to follow their Facebook page for the latest deets on promos and updates.

Taking baby steps into the world of adulting will come at some point in our lives as millennials and gen-Zs.

Investing – like growing up & leaving the proverbial nest – doesn’t have to be a hassle, with the help of platforms that help us make informed choices about our future & the future of Singapore’s smol businesses.

Just like us, they won’t be smol forever, and we’d like to be part of the process of success together.

Disclaimer: This article is not intended to be and does not costitute financial advice or investment advice. All investments bear an element of risk and anyone who chooses to make investments are fully responsible for making their own decisions. Always be smart, and do your own research.